CME Milk Futures Trading System

Class III milk futures traded on the Chicago Mercantile Exchange (CME) represent a standardized financial contract for the future delivery of Grade A milk used in the production of cheese. These futures contracts provide a mechanism for market participants to manage and hedge against price fluctuations in the Class III milk market.

Milk futures exhibit favorable characteristics for trend following trading systems, making them attractive instruments for traders. The dynamics of the milk futures market, particularly Class III milk on the Chicago Mercantile Exchange (CME), contribute to their compatibility with trend-following strategies.

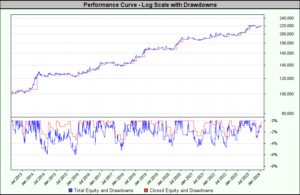

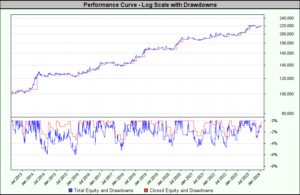

Here we feature one of our Milk Futures breakout trading systems traded with a fixed fractional money management strategy risking 2% of the account balance per trade. For those seeking a comprehensive report or additional insights into how Iron Milk performs in conjunction with other markets exhibiting low correlation, please get in touch.

TS Milk Summary Results

|

|

Stepped Parameter Summary Performance

| Test |

Ending Balance |

Ending VADI |

CAGR% |

MAR |

Modified Sharpe |

Annual Sharpe |

Max Total Equity DD |

Longest Drawdown |

# Trades |

|

| 1 |

|

219,670.09 |

219,670.09 |

7.39% |

1.23 |

1.13 |

1.19 |

6.0% |

23.3 |

86 |

|

|

|

|

|

|

|

|

|

|

|

Yearly Performance Summary

| Year |

Days |

Closed Balance |

End Total Equity |

End VADI |

Total Equity Gain |

Gain % |

# Trades |

|

| 2013 |

365 |

105,634.07 |

110,474.07 |

110,474.07 |

10,474.07 |

10.5% |

7 |

| 2014 |

365 |

126,326.38 |

126,326.38 |

126,326.38 |

15,852.31 |

14.3% |

9 |

| 2015 |

365 |

123,485.52 |

127,805.52 |

127,805.52 |

1,479.14 |

1.2% |

9 |

| 2016 |

366 |

138,960.69 |

143,160.69 |

143,160.69 |

15,355.17 |

12.0% |

8 |

| 2017 |

365 |

138,879.54 |

142,399.54 |

142,399.54 |

-761.15 |

-0.5% |

10 |

| 2018 |

365 |

166,190.52 |

166,190.52 |

166,190.52 |

23,790.97 |

16.7% |

6 |

| 2019 |

365 |

169,918.23 |

167,758.23 |

167,758.23 |

1,567.71 |

0.9% |

8 |

| 2020 |

366 |

190,875.68 |

190,875.68 |

190,875.68 |

23,117.45 |

13.8% |

5 |

| 2021 |

365 |

193,194.50 |

195,194.50 |

195,194.50 |

4,318.83 |

2.3% |

9 |

| 2022 |

365 |

196,329.84 |

199,849.84 |

199,849.84 |

4,655.34 |

2.4% |

9 |

| 2023 |

365 |

217,515.09 |

219,935.09 |

219,935.09 |

20,085.25 |

10.1% |

5 |

| 2024 |

17 |

219,670.09 |

219,670.09 |

219,670.09 |

-265.00 |

-0.1% |

1 |

|

|

|

|

|

|

|

|

Instrument Performance Summary

| Symbol |

Wins |

% |

Losses |

% |

Trades |

Win Months |

% |

Loss Months |

% |

Avg. Win % |

Avg. Loss % |

Avg. Trade % |

% Profit Factor |

|

| DA2 |

46 |

53.5% |

40 |

46.5% |

86 |

79 |

59.4% |

54 |

40.6% |

2.47% |

0.78% |

0.96% |

3.64 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Test Period for parameter run 1. |

|

| First Test Date |

2013-01-01 |

| Last Test Date |

2024-01-17 |

|

|

| Trading Performance |

|

| CAGR % |

7.39% |

| MAR Ratio |

1.23 |

| RAR % |

7.07% |

| R-Squared |

0.971 |

| R-Cubed |

1.34 |

| Avg Margin to Equity Ratio |

1.49% |

|

| Daily Return % |

0.0280% |

| Average Monthly Return % |

0.6106% |

| Daily Geometric Return % |

0.0195% |

| Daily Standard Deviation % |

0.37% |

| Annualized Daily StandDev % |

6.04% |

| Monthly Standard Deviation % |

1.88% |

| Annualized Monthly StandDev % |

6.50% |

| Daily Downside Deviation % |

0.24% |

|

| Daily Sharpe Ratio |

0.075 |

| Daily Geo Sharpe Ratio |

0.052 |

| Modified Sharpe Ratio |

1.13 |

| Annual Sharpe Ratio |

1.19 |

| Monthly Sharpe Ratio |

0.33 |

| Robust Sharpe Ratio |

1.09 |

|

| Daily Sortino Ratio |

0.117 |

| Annual Sortino Ratio |

46.94 |

| Monthly Sortino Ratio |

0.80 |

| Calmar Ratio |

1.76 |

|

| Maximum Total Equity Drawdown % |

6.01% |

| Longest Total Equity Drawdown (months) |

23.26 |

| Average Max TE Drawdown % |

5.00% |

| Average Max TE Drawdown Length (months) |

12.64 |

| Maximum Monthly Total Equity Drawdown % |

4.19% |

| Maximum Monthly Closed Equity Drawdown % |

3.33% |

| Maximum Closed Equity Drawdown % |

3.39% |

| Average Closed Equity Drawdown % |

0.95% |

|

| Round Turns Per Million |

109 |

| Round Turns |

182 |

| Total Trades |

86 |

|

| Start Account Balance |

100,000.00 |

| Total Win Dollars |

168,603.02 |

| Total Loss Dollars |

48,932.93 |

| Total Profit |

119,670.09 |

| Earned Interest |

0.00 |

| Margin Interest |

0.00 |

| End Closed Equity |

219,670.09 |

| End Open Equity |

0.00 |

| End Total Equity |

219,670.09 |

|

| Highest Total Equity |

222,063.47 |

| Highest Closed Equity |

220,184.55 |

|

| Total Commissions |

1,820.00 |

| Commission per Round Turn |

10.00 |

| Total Slippage |

1,269.91 |

| Slippage per Round Turn |

6.98 |

| Total Forex Carry |

0.00 |

| Total Dividends |

0.00 |

| Total Other Expenses |

0.00 |

| Fees Incentive Accrued |

0.00 |

| Fees Management Accrued |

0.00 |

| Fees Incentive Total |

0.00 |

| Fees Management Total |

0.00 |

| Capital Adds Draws Total |

0.00 |

|

|

|

|

| Win/Loss Statistics |

|

| Wins |

46 |

53.5% |

| Losses |

40 |

46.5% |

|

| Total |

86 |

100.0% |

|

| Winning Months |

79 |

59.4% |

| Losing Months |

54 |

40.6% |

|

| Total |

133 |

100.0% |

|

| Average Risk Percent |

1.57% |

| Average Win Percent |

2.47% |

| Average Loss Percent |

0.78% |

| Win/Loss Percent Ratio |

3.17 |

| Average Win Dollars |

3,665.28 |

| Average Loss Dollars |

1,223.32 |

| Win/Loss Dollars Ratio |

3.00 |

| Average Trade Percent |

0.96% |

| Average Trade Duration |

31.13 |

| Average Trade Dollars |

1,391.51 |

|

| Profit Factor |

3.45 |

| Percent Profit Factor |

3.64 |

| Expectation |

0.61 |

|

|

|

| Equity Management |

|

|

| Test Starting Equity |

100,000.00 |

| Order Generation Equity |

0.00 |

| Order Generation Equity High |

0.00 |

| Leverage (fraction) |

1.00000000 |

| Trading Equity Base |

Total Equity |

| Drawdown Reduction Threshold (%) |

0.00% |

| Drawdown Reduction Amount (%) |

0.00% |

|

|

| Global Simulation Parameters |

|

| Earn Interest |

False |

| Slippage Percent |

0.00% |

| Minimum Futures Slippage |

0.00 |

| Max Percent Volume Per Trade |

0.00% |

| Max Margin Equity |

100.00% |

| Trade Always on Tick |

True |

| Smart Fill Exit |

True |

| Entry Day Retracement |

-1.00% |

| Max Units |

1 |

| Use Broker Positions |

False |

| Thread Count |

1 |

|

| Walk Forward Optimization |

365 |

| Walk Forward OOS |

9,125 |

|

| Minimum Futures Volume |

0 |

| Commission per Contract |

10.00 |

| Trade on Lock Days |

False |

| Account for Contract Rolls |

True |

| Roll Slippage in % of ATR |

5.00% |

|

| Minimum Stock Volume |

10,000 |

| Commission per Stock Trade |

0.00 |

| Commission per Stock Share |

0.010 |

| Commission per Forex Trade |

0.00 |

| Commission by Stock Value (%) |

0.00% |

| Sell Stock Split Remainder |

True |

| Earn Dividends |

True |

| Pay Margin on Stocks |

True |

|

| Forex Trade Size |

1,000.00 |

| Account for Forex Carry |

True |

| Use Pip Based Slippage |

False |

|

| Management Fee |

0.00% |

| Management Fee Period |

Daily |

| Incentive Fee |

0.00% |

| Incentive Fee Period |

Daily |

| Use Capital Adds Draws |

True |

|

|

| Preferences |

|

| Risk Free Rate |

0.00% |

| Load Volume |

True |

| Load Unadjusted Close |

True |

| Process Weekly Bars |

False |

| Process Monthly Bars |

False |

| Process Daily Bars |

False |

| Process Weekends |

True |

| Additional Years of Data |

5.00 |

|

|

|

Required Disclaimer – Commodity Futures Trading Commission: Futures and options trading has large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. Don’t trade with money you can’t afford to lose. This website is neither a solicitation nor an offer to Buy/Sell futures or options. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this website. The past performance of any trading system or methodology is not necessarily indicative of future results

CFTC RULE 4.41 – HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY, SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.

![]()