01

Cost-Effective And Liquid

02

Global Market Access

03

Trading Nearly 24 Hours a Day

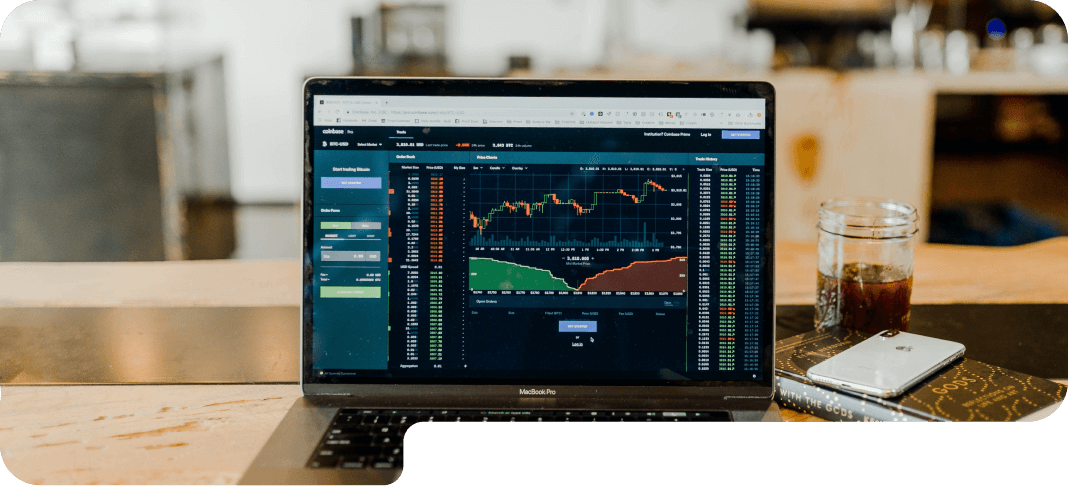

Why Trade Futures and Diversify Your Portfolio?

Here Are Eight Reasons

To Choose Wisdom Trading:

01

Access to Global Markets

Futures trading offers access to a wide range of global markets, including commodities, currencies, stock indices, interest rates, and more. By trading futures, you can capitalize on diverse investment opportunities around the world, allowing you to tap into various sectors and economies.

Enhanced Liquidity

03

Broad Diversification

Diversifying your portfolio across different asset classes, such as stocks, bonds, and commodities, is a fundamental principle of risk management. Futures trading allows you to diversify your investments further, as futures contracts cover a wide array of underlying assets. By adding futures to your portfolio, you can potentially reduce the overall risk exposure and enhance the potential for consistent returns.

04

Risk Mitigation and Hedging

05

Leverage and Capital Efficiency

Transparency and Regulation

07

24/7 Trading Opportunities

08

Potential Profit in Bull and Bear Markets

One of the unique features of futures trading is the ability to profit from both rising and falling markets. By taking long or short positions, traders can potentially capitalize on market trends in any direction. This flexibility enables traders to adapt their strategies to changing market conditions and seek profit opportunities in all market environments.