How it Works:

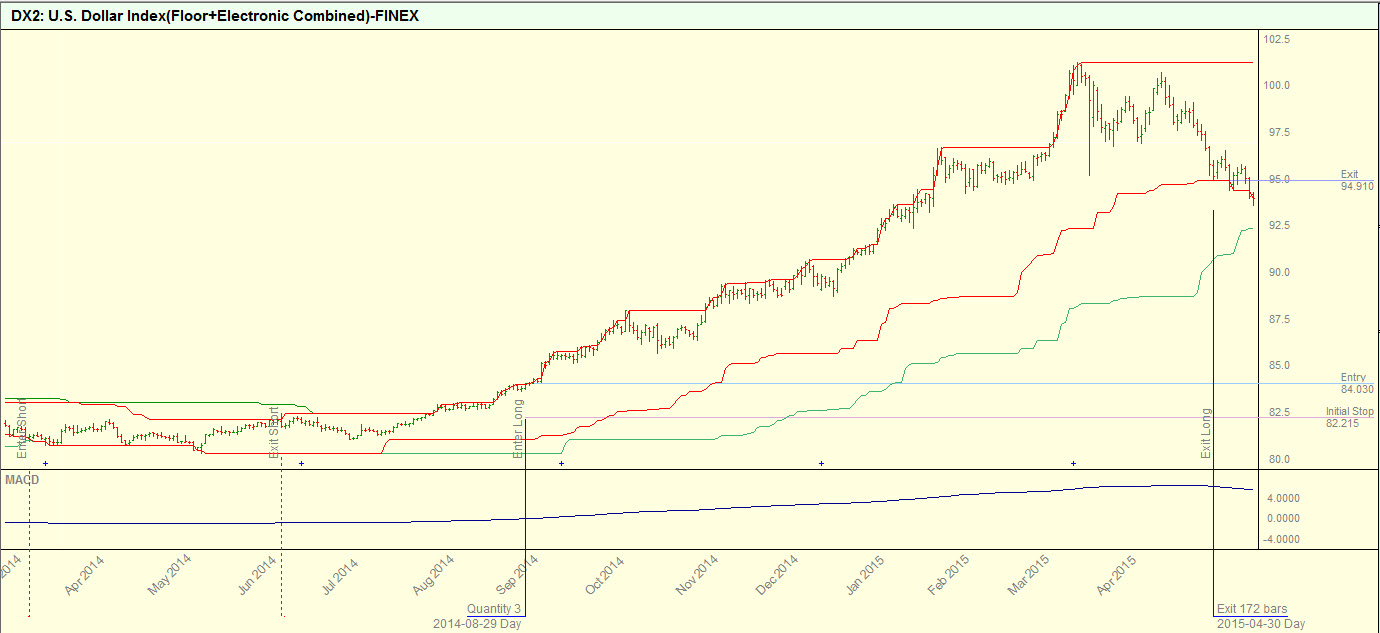

The Donchian System operates by capitalizing on breakouts. It employs two breakout thresholds: a longer one for entry and a shorter one for exit.

In this system, a stop mechanism rooted in the Average True Range (ATR) is utilized. When the price touches the high or low of the preceding X-days, a trade is initiated. For instance, with an Entry Breakout set at 20 days, a long position is initiated if the price reaches the 20-day high, while a short position is triggered if it hits the 20-day low. Concurrently, ongoing trades are closed out when the price touches the high or low of the preceding X-days.

This mechanism mirrors the Entry Breakout logic, albeit with reversed conditions: Long trades are terminated upon reaching the X-day low, while short trades are exited upon touching the X-day high.

The Exit Breakout dynamically adjusts alongside price movements, serving to mitigate adverse price fluctuations and function as a trailing stop to secure profits when the trend reverses.

Trades are terminated when the price intersects with either the Exit Breakout, the Entry Breakout for the opposite direction, or the ATR-based Stop, whichever is nearest to the prevailing price.